Want to save $3000 in 3 months? With a solid plan and commitment, it’s absolutely achievable. By making small lifestyle adjustments, setting a strict budget, and finding additional sources of income, you can reach your savings goal faster than you think. In this article, we will dive into practical tips and strategies on how to save 3000 in 3 months. Let’s get started on your journey to financial success!

How to Save $3000 in 3 Months

Are you looking to boost your savings quickly? Saving $3000 in just three months may sound like a challenging goal, but with the right strategies and dedication, it’s definitely achievable. In this comprehensive guide, we will explore a variety of practical tips and tricks to help you reach your financial target in a short period of time. Let’s dive in!

Setting Your Savings Goal

Before embarking on this savings journey, it’s essential to establish a clear and realistic goal. Saving $3000 in three months means setting aside approximately $1000 each month. Take some time to review your current income, expenses, and spending habits to determine how much you can comfortably save each month. Setting a specific target will help you stay focused and motivated throughout the process.

Creating a Budget

One of the most effective ways to save money is by creating a budget. Start by listing all your sources of income and expenses. Identify areas where you can cut back or eliminate unnecessary spending. Consider packing your lunch instead of eating out, brewing your coffee at home, or canceling unused subscriptions. Redirecting these savings towards your goal will add up quickly.

Cutting Down on Expenses

To reach your savings target, it’s crucial to trim down non-essential expenses. Evaluate your monthly bills and look for opportunities to reduce costs. Consider negotiating with service providers for better deals or switching to more affordable alternatives. Cutting back on dining out, entertainment, and shopping can free up significant funds to put towards your savings goal.

Automating Your Savings

Automating your savings is a convenient way to ensure that you consistently set aside money towards your goal. Set up automatic transfers from your checking account to a dedicated savings account each time you receive a paycheck. By automating this process, you remove the temptation to spend the money elsewhere and make saving a seamless part of your financial routine.

Increasing Your Income

In addition to cutting expenses, boosting your income can expedite your savings progress. Explore opportunities to earn extra money, such as taking on a part-time job, freelancing, or selling unused items. Consider leveraging your skills and hobbies to generate additional income streams. Every extra dollar earned can bring you closer to reaching your $3000 target.

Setting Aside Windfalls

Unexpected windfalls, such as tax refunds, bonuses, or gifts, can provide a significant boost to your savings. Rather than splurging this extra money, consider allocating a portion or the entirety towards your savings goal. Windfalls offer a great opportunity to accelerate your progress and reach your target ahead of schedule.

Tracking Your Progress

Monitoring your savings progress is essential to stay motivated and on track. Regularly review your budget, expenses, and savings contributions to gauge how close you are to reaching your $3000 goal. Celebrate small milestones along the way to stay motivated and reinforce positive saving habits. Seeing your progress will inspire you to keep going until you hit your target.

Staying Committed and Motivated

Saving $3000 in three months requires dedication and discipline. Stay committed to your goal, even when faced with challenges or temptations to stray from your plan. Remind yourself of the reasons behind your savings goal and the financial security it will bring. Surround yourself with supportive friends or family members who can cheer you on during this journey.

Rewarding Yourself

While saving diligently is crucial, it’s also important to reward yourself along the way. Set aside a small portion of your savings for a treat or indulgence once you reach certain milestones. Treating yourself occasionally can help you stay motivated and prevent burnout. Just ensure the rewards are within your budget and won’t derail your progress.

Planning for Future Goals

As you work towards saving $3000 in three months, it’s valuable to start thinking about your next financial goals. Whether it’s building an emergency fund, investing for the future, or saving for a major purchase, having a clear roadmap for your money beyond this target will keep you focused and motivated even after you achieve this milestone.

In conclusion, saving $3000 in three months is an achievable goal with careful planning, budgeting, and commitment. By implementing the strategies outlined in this guide and staying disciplined in your saving efforts, you can successfully reach your financial target and set yourself up for greater financial stability in the future. Start today, stay focused, and watch your savings grow!

3,000 IN 3 MONTHS | HOW TO SAVE MONEY | SAVING CHALLENGES | TAMMIE

Frequently Asked Questions

How can I save $3000 in 3 months?

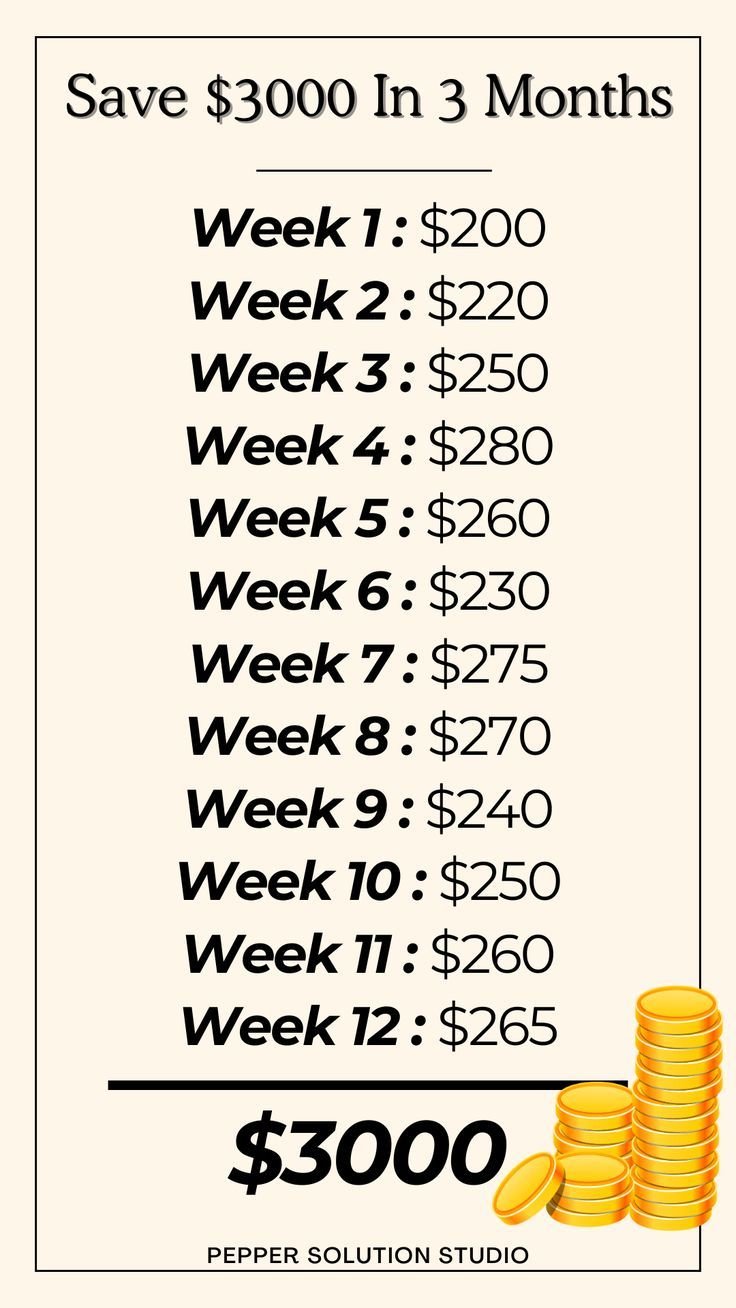

To save $3000 in 3 months, you can start by creating a budget to track your expenses and identify areas where you can cut back. Consider setting a specific savings goal each week to reach your target amount. You can also look for ways to increase your income, such as taking on a side hustle or selling unused items. Additionally, automate your savings by setting up automatic transfers from your checking account to a dedicated savings account.

What are some practical tips for cutting back expenses to save $3000 in 3 months?

To cut back on expenses and save $3000 in 3 months, consider reducing discretionary spending such as dining out, shopping, and entertainment. Look for areas where you can make small changes, such as brewing your coffee at home, meal prepping, using public transportation, or cancelling unnecessary subscriptions. Prioritize your needs over wants and be mindful of impulse purchases to stay on track with your savings goal.

Is it possible to save $3000 in 3 months without sacrificing quality of life?

Yes, it is possible to save $3000 in 3 months without sacrificing the quality of your life. Focus on making smart choices with your spending rather than depriving yourself. Look for free or low-cost alternatives for activities, opt for homemade meals instead of dining out, and take advantage of discounts and deals when needed. By being mindful of your spending habits and setting clear priorities, you can reach your savings goal without compromising your lifestyle.

Final Thoughts

To save $3000 in 3 months, focus on cutting daily expenses, increasing income, and setting a realistic budget. Prioritize needs over wants, track spending diligently, and consider side gigs for extra cash. Automate savings to ensure consistency. Build an emergency fund to avoid dipping into savings. By following these steps consistently, achieving the goal of saving $3000 in 3 months becomes attainable. Start today and watch your savings grow steadily.